Basic Thinking on Corporate Governance, Capital Structure, Corporate Profile and Other Basic Information

The Samty Group views the strengthening of corporate governance as a key management issue. The Group’s basic thinking on corporate governance is to implement rigorous compliance and improve the transparency and soundness of management activities, then pursue the continuous growth of the Company and earn the trust of society by maintaining efficient management and a strong competitive advantage.

Based on the above basic thinking on corporate governance, and drawing on the provisions of the principles of the Corporate Governance Code, it is the Group’s policy to establish appropriate corporate governance by implementing a structure that enables the dissemination of timely, accurate information, strengthening our information management system, rigorously complying with laws, using independent outside directors, and so forth.

Furthermore, we strengthened the supervisory function of the Board of Directors and enhanced corporate governance along with transitioning to a company with an Audit and Supervisory Committee to further improve the transparency of management and accelerate decision-making.

Matters Concerning Business Execution, Auditing and Supervision, Nomination, and Remuneration Decisions (Overview of the Current Corporate Governance System)

Business Execution

1. Board of Directors

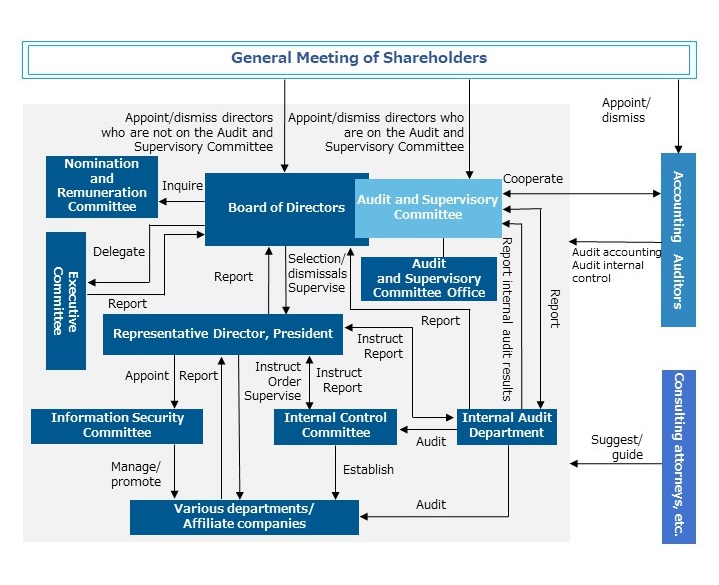

The Company's Board of Directors consists of nine directors (including four outside directors, but not including those who are members of the Audit and Supervisory Committee) with a term of office of one year, and four outside directors who comprise the Audit and Supervisory Committee and who have a term of office of two years. The Board of Directors, as the decision-making body for important matters related to business execution, makes resolutions on matters stipulated by law and the Articles of Incorporation as well as matters related to important business operations, and supervises the execution of duties by directors. In addition to regular monthly meetings of the Board of Directors, extraordinary meetings of the Board of Directors are held when necessary to ensure prompt decision-making on important management matters.

2. The Audit and Supervisory Committee

The Audit and Supervisory Committee consists of four people. In order to monitor the execution of duties by directors from an objective and neutral standpoint, all four members of the Audit and Supervisory Committee are outside members, and the committee is one that is able to grasp important management matters, important matters concerning compliance and risk management, and other matters as needed through attendance at important meetings, inspection of minutes, inspection of all approved documents (every time), regular meetings with all directors, and, as necessary, interviews of directors regarding the execution of duties. In addition, as one of the items to be reported at regular meetings of the Board of Directors, the Company has established a time for Audit and Supervisory Committee members to make comments, so it is a system where the Board receives reports, requests, suggestions, etc. Through these measures, the Company audits the decision-making process at Board of Directors meetings and the status of business execution by directors.

3. Executive Committee

The Executive Committee is a deliberative body delegated by the Board of Directors to make decisions on certain important business operations. In addition to matters delegated by the Board of Directors, the Executive Committee also deliberates in advance on matters to be discussed at the Board of Directors meetings and other matters related to the overall management and business execution of the Company. The Committee is composed of all directors except outside directors (the chairperson and members are below) and, in principle, is held once a week. Outside directors (including those who are members of the Audit and Supervisory Committee) may participate in the meetings as necessary.

Chairperson: Yasuhiro Ogawa, Representative Director and President

Members:

Takaharu Terauchi, Deputy President

Hiroaki Matsui, Managing Director

Naohiro Morita, Managing Director

Jiro Okawa, Director

Takashi Hamamatsu, Director

4. Status of Internal Audits

The Internal Audit Office conducts internal audits of the Company's divisions and group companies in accordance with internal audit regulations, etc., and reports the results to the Board of Directors, the President, Audit and Supervisory Committee, and the audited division, etc., pointing out areas for improvement as necessary. In addition, the internal auditors and accounting auditors strengthen cooperation through meetings for sharing information.

5. Status of Accounting Auditors

The Company has entered into an audit contract with Aria Audit Corporation for audits based on the Companies Act and audits based on the Financial Instruments and Exchange Act. There are no special interests between the Company and this audit firm or the managing partners of this audit firm who are engaged in these audits.

The Company has transitioned to a "Company with Audit and Supervisory Committee" to further improve the transparency of management and to further accelerate decision-making by strengthening the supervisory function of the Board of Directors and enhancing corporate governance.

We recognize that improving our governance is an important management issue, and we are working to strengthen our corporate governance system by implementing the aforementioned measures in conjunction with the internal controls described below.

Basic Thinking on Internal Control and the Status of its Development

1. Ensuring That the Execution of Directors’ and Employees’ Duties Complies with the Law and Articles of Incorporation

(1)Management Philosophy and Code of Conduct

Directors and employees must comply with the law, the Articles of Incorporation, and societal norms as a matter of course, and the Company has a Management Philosophy and Code of Conduct that establish shared standards for engaging in business conduct that is highly ethical, sincere, and appropriate.

(2)Compliance Regulations and Compliance Manual

The Company has Compliance Regulations and a Compliance Manual that serve as the basic rules regarding the Group’s compliance management and promote rigorous legal compliance, the establishment of a compliance management system, and education and awareness activities.

(3)Compliance Management

To ensure the effectiveness of compliance management, the Company appoints the director responsible for the Legal 20 Department as the compliance officer, and the Legal Department serves as the compliance department. To ensure thorough awareness and practical implementation of the Management Philosophy, Code of Conduct, Compliance Regulations, and Compliance Manual, the compliance department formulates action plans for executing compliance management, and based on this, it holds training workshops, verifies legal compliance, and conducts daily monitoring activities. Moreover, to ensure comprehensive implementation of internal control as a whole, the legal department works to enhance the internal control throughout the company.

(4)Whistleblowing Policy

The Company has a whistleblowing policy that enables Company and Group company employees to communicate directly with the compliance department, Audit and Supervisory Committee, or an outside contact desk regarding actions that violate the law and similar matters, and people with knowledge of such actions must report them to the company. Moreover, if circumstances that require remedial measures should arise, the appropriate measures will be taken promptly, and the compliance officer will report the results of any investigations and remedial measures to the Board of Directors and the Audit and Supervisory Committee.

(5)Ensuring the Reliability of Financial Reporting

To ensure the reliability of financial reporting, based on the Company’s Accounting Compliance Declaration, it will foster a high level of compliance awareness, make accounting audits more transparent, strengthen internal controls, and improve the transparency of information disclosure. Specifically, the Company has a Basic Policy on Financial Reporting that stipulates the basic policy and the role of internal control. Based on this basic policy, the accounting department has policies for ensuring the reliability of financial reporting through the communication of information necessary for appropriate disclosure of financial results and the formulation of measures for information sharing with accounting auditors, etc., along with internal control based on the Companies Act, and also conducts continuous evaluations and makes improvements if there are any deficiencies.

(6)Preventing Damage by Anti-Social Forces and Banning Relationships with Anti-Social Forces

To prevent damage by anti-social forces and ban relationships with them, the Personnel and General Affairs Department has overall responsibility for measures against them. The Personnel and General Affairs Department has a manual for this and acts systematically in collaboration with attorneys, the police, etc. if necessary.

(7)Internal Auditing

The Internal Audit Department audits the status of compliance management throughout the company and reports its findings to the Representative Director & President, the Board of Directors and the Audit and Supervisory Committee. If improvements are required as a result of auditing, the audited department will promptly implement measures.

2. Saving and Managing Information Relating to the Execution of Directors’ Duties

(1)Saving and Managing Documents

Board minutes, approval request documents, and other information relating to the execution of directors’ duties are recorded in writing (includes electronic records) and saved and managed in an appropriate manner based on the Written Document Management Regulations and other internal regulations.

(2)Information Security Measures

The Company has a Basic Information Security Policy and an information security management system (ISMS).

3.Regulations and Other Systems Related to Managing the Risk of Loss

(1)Risk Management Regulations and Emergency Response Regulations

The Company has Risk Management Regulations as basic regulations for risk management and organizations for managing risk during normal times and in emergencies. It has Emergency Response Regulations as separate regulations that stipulate the measures to be taken in emergencies, and it has a system for promptly evaluating the circumstances in the event of such a situation and taking prompt, appropriate steps to minimize losses.

(2)Risk Management During Normal Times

The Company has the director in charge of the Legal Department as the director responsible for risk management, and the Legal Department serves as the department responsible for general risk management. The Legal Department has an action plan for managing risk, and verifies and evaluates the status of risk management based on this, implements countermeasures, and so forth.

(3)Emergency Response Department

If an emergency arises, an emergency response department led by the Representative Director & President will be established, and measures will be taken in an organized manner based on the Emergency Response Regulations and Detailed Regulations on Measures for Severe Natural Disasters, Etc.

(4)Internal Audits

The Internal Audit Department audits the status of risk management throughout the company and reports its findings to the Representative Director & President, the Board of Directors and the Audit and Supervisory Committee. If improvements are required as a result of auditing, the audited department will promptly implement measures.

4.Ensuring the Directors Execute Their Duties Efficiently

(1)Board of Directors’ Meetings and Business Execution Meetings

To rapidly make decisions on important matters stipulated in the Board of Directors’ Regulations, regular Board of Directors’ meetings are held once per month and extraordinary Board of Directors’ meetings are held as needed. The Board discusses matters relating to the Company’s overall management and business execution, and the Business Execution Committee is the managerial body for determining policies. The Business Execution Committee is, as a general rule, composed of all directors except outside directors and members of the Audit and Supervisory Committee, and holds meetings once per week. The outside directors and members of the Audit and Supervisory Committee may, as necessary, attend meetings of the Business Execution Committee.

(2)Business Execution Decisions

The Board of Directors determines the duties of the directors and executive directors, and each director and executive director must execute his or her duties in accordance with this decision. For the execution of day-to-day duties, authority may be transferred based on the Organization Regulations (administrative authority chart) and Division of Duties Regulations, and the people in charge at each level must execute their duties in accordance with the decision-making rules. Moreover, meetings attended by directors and business managers are held once per month with the aim of verifying the status of business execution and improving its efficiency.

(3)Medium-Term Management Plan and Annual Budget

The Board of Directors formulates Medium-Term Management Plans and, based on these, drafts an annual budget in accordance with the general budgeting policy. To rigorously manage the budget, meetings are held once per month to analyze the reasons for surpluses or shortfalls and, in the case of shortfalls, report on improvement measures and revise targets if necessary.

(4)Internal Auditing

The Internal Audit Department monitors the status of business management and, to make improvements, audits its efficiency and effectiveness and reports its findings to the Representative Director & President.

5.Ensuring the Appropriateness of Business Practices in the Corporate Group

The Corporate Planning Department is the department in charge of ensuring the appropriateness of the Group’s business practices. The Corporate Planning Department receives various reports and manages Group companies through affiliate company meetings, etc. held based on the Affiliate Company Management Regulations. Moreover, the Company promotes integrated compliance for the Group based on the Compliance Regulations and Compliance Manual. Other Group companies are able to use the Company’s whistleblowing system, and if necessary, the Company provides other Group companies with advice on compliance and risk management-related matters. Group companies must manage their business based on the division of duties and powers stipulated by each company. The Company dispatches directors to supervise the business of key Group companies. The Internal Audit Department audits the Company’s Group management as well as key Group companies and reports its findings to the Representative Director & President, the Board of Directors and the Audit and Supervisory Committee.

6.Matters Relating to Employees Who Should Support the Audit and Supervisory Committee in Its Duties

The Audit and Supervisory Committee Office supports the Audit and Supervisory Committee in its duties. The employees of the Audit and Supervisory Committee Office are not subject to any directives or orders from directors, etc., in the course of their auditing duties, and their independence from directors is ensured with respect to personnel transfers, evaluations, etc. In addition, they are authorized to collect necessary information under the direction of the Audit and Supervisory Committee. If these employees are concurrently serving in other capacities, they must carry out their orders with priority given to the directions of the Audit and Supervisory Committee.

7.Reporting to the Audit and Supervisory Committee and Ensuring That Auditing Is Effectively Implemented by the Audit and Supervisory Committee

(1)Reporting to the Audit and Supervisory Committee

The Group’s officers and employees must report the matters below to the Audit and Supervisory Committee without delay. Moreover, people who report these matters must not be subject to any detrimental treatment whatsoever because they reported these matters.

①Important matters related to management

②Important matters related to compliance and risk management

③Important matters related to ensuring the reliability of financial reporting

④All internal approval request documents

⑤Minutes of important meetings or meetings requested by the Audit and Supervisory Committee

⑥Matters liable to have a major impact on Group companies’ business or financial status

⑦Other matters requested by the Audit and Supervisory Committee

(2)Ensuring That Auditing Is Effectively Implemented by the Audit and Supervisory Committee

Based on the annual auditing policy and auditing plan, the Audit and Supervisory Committee implements effective auditing using the following methods.

①The Audit and Supervisory Committee attends Board of Directors’ meetings and other important meetings.

②The Audit and Supervisory Committee regularly exchanges information and views with the directors, including the representative directors on issues to be addressed by the company, the status of the environment established for auditing by the Audit and Supervisory Committee, and important auditing-related issues.

③The Audit and Supervisory Committee questions, as needed, directors and employees about the execution of their duties. Moreover, they review important documents such as accounting records and approval requests and, if necessary, request explanations from directors or employees.

④The Audit and Supervisory Committee has employees of the Audit and Supervisory Committee Office attend audits conducted by the Internal Audit Office as necessary and, based on the reports of such audits, ascertains the actual state of operations of each department and requests improvements if there are any deficiencies in the execution of operations.

⑤The Audit and Supervisory Committee receives explanations of the details of the accounting audit from the accounting auditor, and in addition to regular meetings, the Audit and Supervisory Committee seeks to cooperate with the accounting auditor by providing opportunities for the exchange of information and opinions on a daily basis.

(3)Policy Relating to the Prepayment or Reimbursement of Expenses Arising in the Execution of the Audit and Supervisory Committee’s Duties

When the Audit and Supervisory Committee claims expenses that are required to perform audits, those claims cannot be rejected, except in cases where it is deemed that the applicable expenses were not necessary for the execution of the Audit and Supervisory Committee’s duties.

Basic Thoughts on the Elimination of Antisocial Forces

The Company's Compliance Regulations and Compliance Manual stipulate that the Company must resolutely confront antisocial activities and forces and must not have any relationship with them, and the Company is working to eliminate antisocial forces.

The Status of Development of Provisions to Eliminate Antisocial Forces

To prevent damage caused by antisocial forces and sever any relationship with them, the Personnel and General Affairs Department oversees the handling of antisocial forces. The Personnel and General Affairs Department prepares response manuals and other documents, and if necessary, cooperates with lawyers, the police, and other authorities to systematically deal with such forces.

Corporate Governance Organizational Chart